Estate Strategy

The Estate Strategy page shows the current status of the clients’ estate. By default, NaviPlan creates a simple will estate distribution, assuming that all assets will pass to the surviving spouse. On this tab, you can enter any strategies the clients are currently using, such as gifts or trusts. As you add information, the graph at the top of the page updates to show how the changes affect the clients’ existing estate plan.

This page is for new strategies only, any pre-existing estate strategies should be entered on the Funded Trusts page or the Gifting Growth & History page.

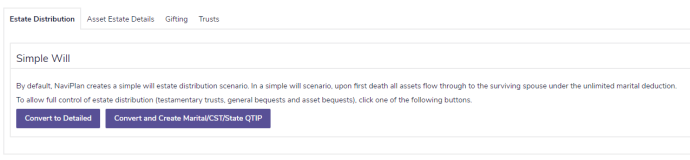

Estate Distribution

To enter estate distribution strategies, follow these steps:

- Go to the Set Goals – Estate Planning – Estate Strategy page.

-

Select the Estate Distribution tab.

Set Goals - Estate Planning page - Estate Strategy tab - Estate Distribution tab

-

To convert a simple will estate distribution to a detailed estate distribution where you can enter testamentary trusts, general bequests, and asset bequests, click Convert to Detailed.

Note: The Convert to Detailed button does not appear if the simple will estate distribution has already been converted to a detailed estate distribution.

OR

To convert a simple will estate distribution to a detailed estate distribution and automatically create a marital and a credit shelter trust, click Convert and Create Marital/QDOT/CST. The trusts are created automatically.Note: Marital only appears if one or both the clients are US citizens. QDOT only appears if one or both of the clients are resident aliens.Note: Before setting up a general bequest, asset bequest, or testamentary trust, go to the Assumptions page and review the estate distribution details. - On the Estate Distribution tab, you can set up general bequests, asset bequests, and testamentary trusts.

- Click the type of trust or bequest you want to create, and then click Add Trust, Add General Bequest, or Add Asset Bequest.

- Select the appropriate type from the menu, and then enter the details of the trust or bequest.

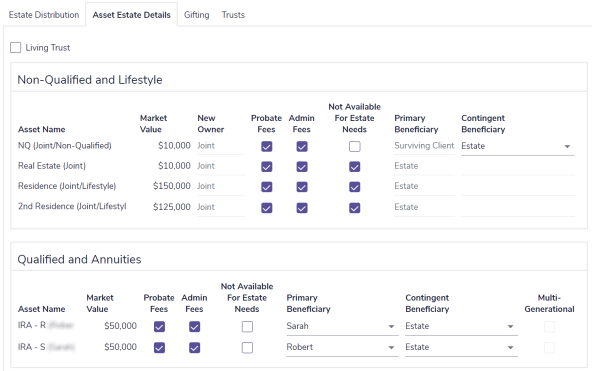

Asset Estate Details

To enter estate detail strategies, follow these steps:

- Go to the Set Goals – Estate Planning – Estate Strategy page.

-

Select the Asset Estate Details tab.

Set Goals - Estate Planning page - Estate Strategy tab - Asset Estate Details tab

- To prevent probate from being assessed against all assets in the client’s and co-client’s gross estate, select the Living Trust option.

- To prevent an asset from being liquidated to cover estate costs, select the Not Available For Estate Needs option.

- To specify the Contingent Beneficiary of a non-qualified account at the death of the owner, under Non-Qualified and Lifestyle, select a beneficiary from the menu.

- To specify a beneficiary for a qualified or annuity asset at the death of the owner, under Qualified and Annuities, select a beneficiary from the menu.

- To model a stretch (multi-generational) qualified asset, change the primary beneficiary to someone other than the client or co-client, and then select the Multi-Generational option. When the asset owner dies, the asset will pass to the beneficiary and IRD taxes will be avoided.

Gifting

To enter estate gifting strategies, follow these steps:

- Go to the Set Goals – Estate Planning – Estate Strategy page.

-

Select the Gifting tab.

Set Goals - Estate Planning page - Estate Strategy tab - Gifting tab

- To enter the details of cash gifts that occur on a regular basis, click Regular Cash Gifts. Click Add Regular Cash Gift, and then enter the gift details.

- To enter cash gifts that occur on a one-time basis, click Lump Sum Cash Gifts. Click Add Lump Sum Cash Gift, and then enter the gift details.

- To enter the details of gifts to be made from specific assets, click Asset Gifts. Click Add Asset Gift, and then enter the gift details.

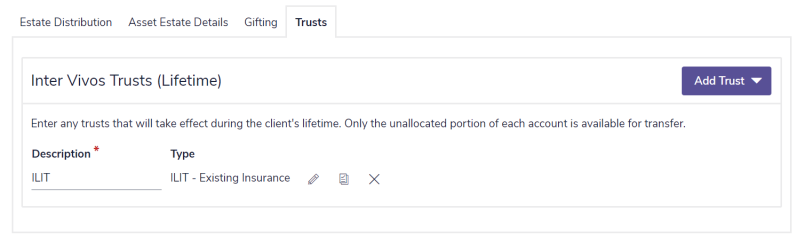

Trusts

To enter estate trust strategies, follow these steps:

- Go to the Set Goals – Estate Planning – Estate Strategy page.

-

Select the Trusts tab.

Set Goals - Estate Planning page - Estate Strategy tab - Trusts tab

- Click the Add Trust button, and then select the type of trust you wish to add. The following trusts are available:

- In just the Estate Planning module:

- Irrevocable trust

- Irrevocable Life Insurance Trusts (ILIT) - Existing Insurance

- Irrevocable Life Insurance Trusts (ILIT) - New Insurance

- With the Advanced Estate module turned on:

- Intentionally Defective Grantor Trust (IDGT)

- Family Limited Partnerships (FLP)

- Qualified Personal Residence Trusts (QPRT)

- Grantor Retained Trusts (GRT)

- Charitable Remainder Trusts (CRT)

- Charitable Lead Trusts (CLT)

- Rolling Grantor Retained Annuity Trusts (GRAT)

- In just the Estate Planning module: